The Municipality of Kawit, Cavite is facing a significant financial setback due to its failure to collect delinquent real property taxes (RPT) and Special Education Tax (SET), according to a recent Commission on Audit (COA) report.

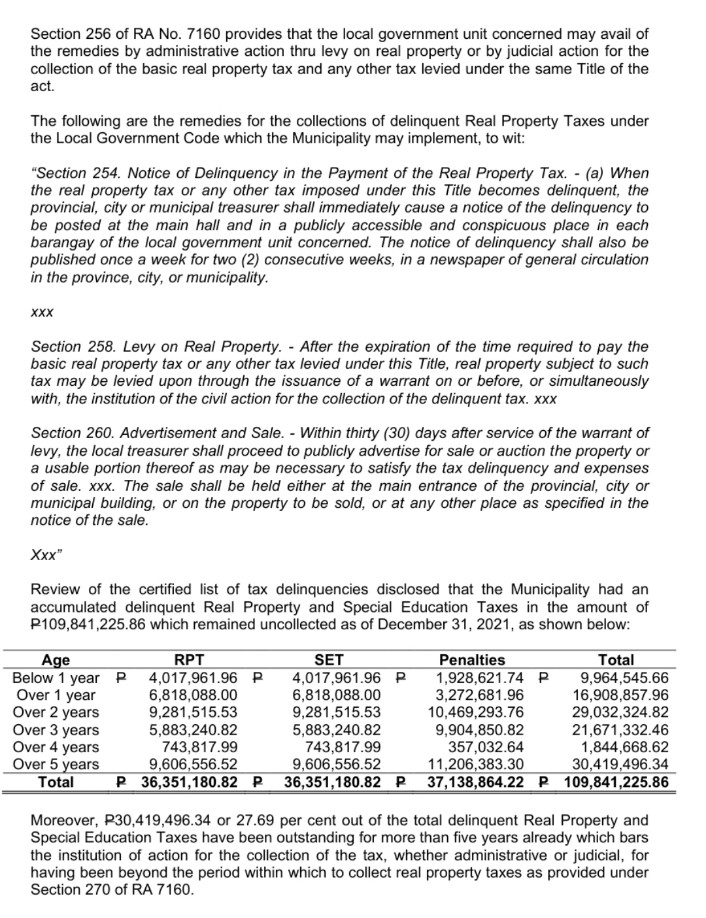

The uncollected taxes have amounted to a staggering PHP109,841,225.86, leading to a cash deficit for the municipality.

The COA report highlighted that the municipality did not implement the measures provided under Section 256 of Republic Act (RA) No. 7160, also known as the “Local Government Code of 1991”.

These measures include administrative actions such as levy on real property and judicial actions for tax collection.

The report further outlined the remedies for the collection of delinquent Real Property Taxes under the Local Government Code.

These include posting and publishing a notice of delinquency, levying on real property after the expiration of the time required to pay the tax, and advertising and selling the property to satisfy the tax delinquency.

The COA emphasized that had the municipality strengthened the imposition of these remedies, it could have realized additional income to address its cash deficit.

Proper monitoring and implementation of collection policies and strategies could also contribute to the collection of past due real property taxes.

COA recommended that Kawit Municipal Mayor Angelo Aguinaldo require the Municipal Treasurer to submit a report outlining specific and time-bound strategies and actions to resolve the issue on delinquent taxes, considering the legal remedies provided under Sections 258 and 260 of RA 7160.

Discover more from Cavite News

Subscribe to get the latest posts sent to your email.